- The global crypto market plunged 2% on Friday shedding over $75 billion as markets reacted to a 400,000 ETH hack involving Bybit Exchange.

- Binance exchange transferred 50,000 ETH to Bybit to buffer liquidity as restore market confidence

- Ethereum showed resillence holding the $2,600 support steady after a 3% dip within hours of the Bybit hack.

Market Chaos Erupts After Bybit’s $1.4 Billion Ethereum Hack

The cryptocurrency market shed $75 billion in a single day, as panic swept through exchanges following a massive security breach at Bybit, one of the world’s largest crypto trading platforms. Hackers stole 400,000 ETH (valued at $1.4 billion) from the exchange’s Ethereum cold wallet, triggering a domino effect across Bitcoin, Ethereum, and major altcoins.

Binance, the industry’s largest exchange, swiftly transferred 50,000 ETH to Bybit to stabilize liquidity and restore confidence. Despite this effort, the broader market nosedived, with Bitcoin (BTC) sliding 4% to $96,200 and Ethereum (ETH) dipping to $2,616. Altcoins bore the brunt of the sell-off, with Dogecoin (DOGE), Cardano (ADA), and Chainlink (LINK) each plunging over 5%.

Bitcoin and Ethereum Struggle to Hold Support

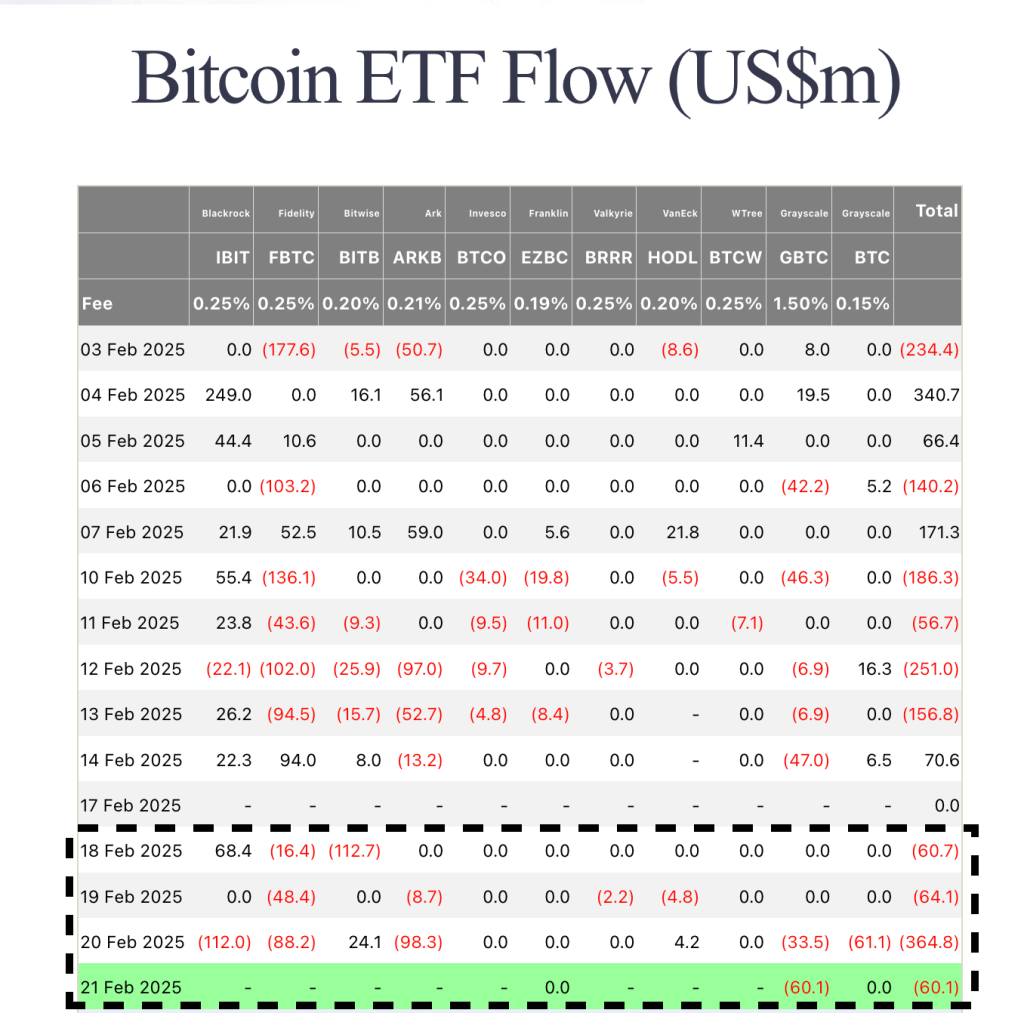

Bitcoin briefly touched $99,495 early Friday before crashing to $96,200 post-hack. Analysts attribute the drop to ETF outflows, with $689.6 million exiting Bitcoin ETFs over four consecutive days.

Ethereum showed resilience, defending its $2,600 support level despite the chaos. However, fears of further sell-offs loom as stolen ETH circulates.

Arkham Tracks Stolen ETH to Lazarus Group Wallets

Blockchain analytics firm Arkham Intelligence identified 53 wallets tied to the hack, linking them to the North Korean Lazarus Group a notorious actor behind previous crypto heists. The stolen ETH, spread across multiple wallets, is reportedly being funneled through decentralized exchanges (DEXs) and cross-chain bridges in suspected laundering attempts.

Bybit CEO Ben Zhou confirmed the breach stemmed from a manipulated multisig transaction but assured users the exchange remains solvent. “We’re working with partners to secure bridge loans and recover funds,” Zhou stated.

Altcoins Bleed as Confidence in CEXs Shakes‘

The hack reignited concerns over centralized exchange (CEX) security, sparking a flight from riskier assets:

- DOGE: -6.4%, erasing weekly gains.

- ADA: -5.9%, battling to hold $0.75.

- LINK: -5.4%, extending a week-long downtrend.

Meanwhile, regulatory scrutiny is expected to intensify, with U.S. authorities monitoring potential sanctions violations tied to Lazarus Group activity.

Regulatory Wins: SEC Drops OpenSea Probe, Coinbase Case Nears End

In brighter news, the SEC closed its investigation into OpenSea without charging the NFT marketplace with securities violations. OpenSea CEO Devin Finzer hailed the decision as a victory for innovation:

“Creators should build freely without unnecessary barriers. This outcome protects the future of NFTs.”

Additionally, the SEC moved to dismiss its lawsuit against Coinbase, which accused the exchange of operating as an unregistered securities platform. If finalized, the dismissal would bar the SEC from refiling the same charges a potential precedent for similar cases.

Solana Integrates First SEC-Approved Yield Stablecoin

Solana announced plans to integrate YLDS, the first SEC-approved yield-generating stablecoin, offering a 3.85% APR via Figure Markets. The token’s yield, based on the SOFR rate minus 0.50%, aims to compete with traditional savings products while leveraging Solana’s high-speed, low-cost infrastructure.

What’s Next?

As the market digests the Bybit fallout, all eyes are on:

- Stolen ETH movements: Will hackers leverage mixers like Tornado Cash?

- Regulatory responses: How will global agencies address CEX vulnerabilities?

- Market recovery: Can Bitcoin reclaim $97K and Ethereum hold $2,600?

For now, the incident underscores crypto’s fragile balance between innovation and security—a lesson the industry continues to learn the hard way.

Leave a Reply