- Bitcoin corrects nearly 6% on Tuesday, down to $86,400.

- Meme coins on Solana and blue-chip tokens like Dogecoin, Shiba Inu, Pepe and TRUMP start recovering.

- Analysts at Nansen identified a risk-off sentiment among crypto traders and commented on catalysts driving Bitcoin’s price lower.

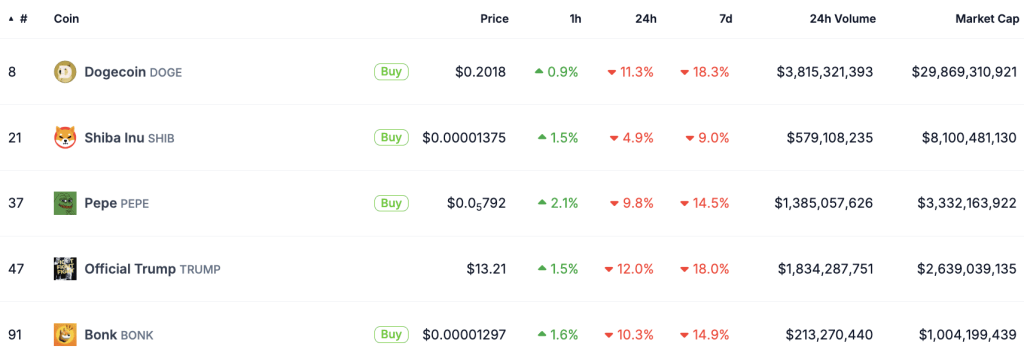

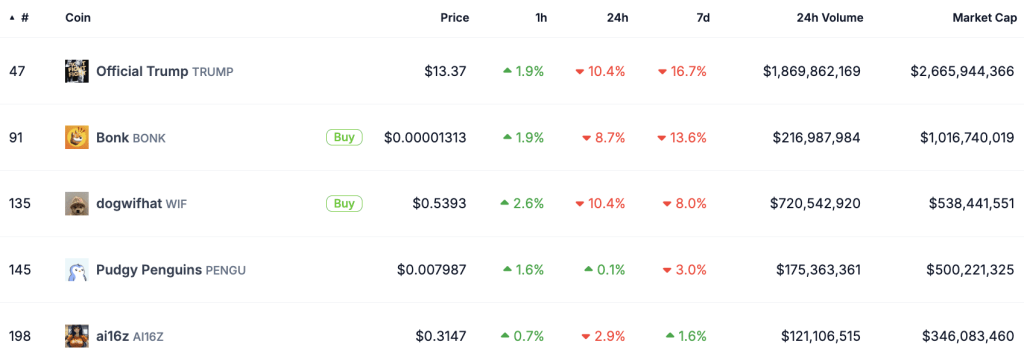

The cryptocurrency market experienced heightened volatility this week as Bitcoin (BTC) plummeted nearly 6% on Tuesday, dropping to approximately $86,400 amid a broader risk-off mood. While Bitcoin struggled to hold above $86,000, meme coins on Solana and blue-chip tokens like Dogecoin (DOGE), Shiba Inu (SHIB), Pepe (PEPE), and TRUMP began to recover losses, signaling a tentative recovery in riskier assets.

Bitcoin Faces Sharp Correction, Liquidations Surge

Bitcoin’s sharp decline below the $90,000 mark triggered massive liquidations across derivatives markets, with traders seeing over $746 million in positions wiped out within 24 hours, according to Coinglass data. The sell-off followed weeks of market turbulence fueled by crypto-specific scandals, including the LIBRA and MELANIA token scams and a $1.4 billion hack of Bybit exchange funds, which were laundered through Solana-based meme coins.

Analysts at blockchain analytics firm Nansen highlighted a clear shift in trader sentiment, noting their proprietary Risk Barometer flipped to “Risk-Off” for the first time since mid-November 2023. In a report titled “BTC Price Finally Breaks, Now What?”, Nansen researchers emphasized Bitcoin’s delayed reaction to broader market weakness, with altcoins already down 14% to 87% from recent highs.

Meme Coins Bounce Back Amid Market Uncertainty

Despite Bitcoin’s stumble, meme coins showed signs of resilience. CoinGecko data revealed blue-chip tokens like DOGE and SHIB edged upward during Tuesday’s North American trading session, trimming their seven-day losses. Solana-based meme coins, which suffered double-digit dips earlier, also rebounded modestly, gaining 1-2% on the day.

The recovery comes after a challenging week for speculative assets, with traders fleeing high-risk tokens amid mounting macroeconomic concerns and crypto-sector shocks. Aurelie Barthere, Principal Research Analyst at Nansen, pointed to the LIBRA scam and Bybit hack as key drivers of the risk-averse mood. “These events likely dampened risk appetite,” Barthere told FXStreet, adding that slowing U.S. economic growth—evidenced by a 22-month low in Services PMI—has compounded fears.

Macroeconomic Pressures and Upcoming Catalysts

Barthere also flagged concerns over U.S. economic health, with GDP growth tracking at a meager 0.6%. Investors now await critical catalysts, including Nvidia’s earnings on February 26 and the U.S. Core PCE Inflation data on February 28, which could sway market trajectories.

Nansen’s report underscored Bitcoin’s lagging response to the altcoin downturn but cautioned that BTC’s break below key support levels may signal further downside. Meanwhile, the partial rebound in meme coins suggests traders are selectively re-entering high-risk bets, though sentiment remains fragile.

Market Outlook: Volatility Ahead

As Bitcoin tests crucial support near $86,000, analysts warn of continued volatility. The interplay of macroeconomic data, corporate earnings, and crypto-specific risks will likely dictate short-term price action. For now, the market’s risk-off pivot underscores a cautious stance among traders, with Bitcoin’s next moves poised to set the tone for the broader crypto landscape.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry significant risk—always conduct your own research before trading.

Leave a Reply