- Dogecoin price declined 12.4% on Friday, trading below $0.19 for the first time since November 2024.

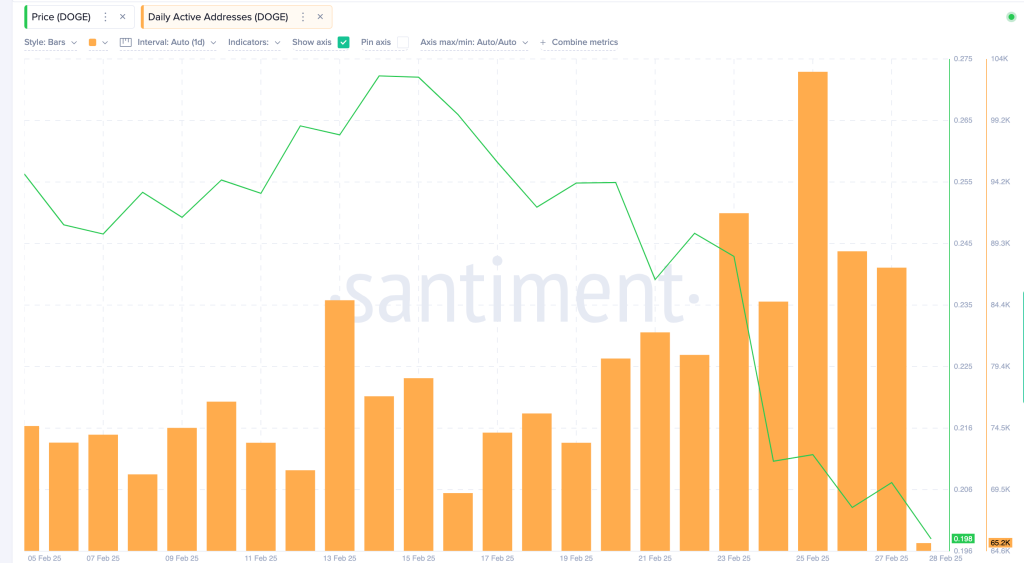

- DOGE’s latest downturn coincided with spikes in daily active addresses, signaling active sell pressure from retail traders.

- Despite trending in oversold territories, the DOGE Relative Strength Index indicator continues to slope further downward.

Dogecoin (DOGE), the meme-inspired cryptocurrency once buoyed by political hype, has plunged to its lowest price since November 2024, sparking panic among retail traders. The asset fell 12.4% on Friday alone, breaching the critical $0.19 support level and erasing nearly half its value in February. Analysts attribute the downturn to geopolitical tensions, regulatory clashes, and a wave of retail sell-offs.

DOGE’s Steep Decline Mirrors Broader Market Uncertainty

Dogecoin opened February at $0.31 but has since nosedived 46% to $0.19 at the time of writing. This drop marks a stark reversal from its late-2024 rally, when DOGE surged on speculation surrounding Elon Musk’s involvement in former President Donald Trump’s re-election campaign. However, the post-inauguration sell-off accelerated this week as macroeconomic headwinds and regulatory uncertainty rattled investors.

Three Key Factors Driving Dogecoin’s Sell-Off

Trump’s Tariff Announcements:

President Trump’s new 25% tariffs on imports from Mexico and Canada, aimed at curbing drug trafficking, spooked markets. Investors fled riskier assets like memecoins amid fears of economic ripple effects.

Elon Musk’s Controversial Government Role:

Musk’s appointment to lead the Department of Government Efficiency (DOGE) has sparked clashes with agencies like the SEC and the U.S. Treasury. His polarizing policies and ties to Dogecoin have amplified bearish sentiment, with traders wary of regulatory crackdowns.

Retail Traders Dump DOGE en Masse:

On-chain data reveals a surge in sell pressure from retail investors. Daily active addresses spiked to 103,500 earlier this week as DOGE broke below $0.25, signaling panic-driven trading. Even as prices fell further, active addresses remained elevated at 87,414 on Thursday, underscoring persistent selling activity.

Technical Analysis: Death Cross Signals More Pain Ahead

Dogecoin’s technical outlook remains grim. A “death cross”—where the 50-day moving average dips below the 200-day average—has formed on the daily chart, historically signaling extended downtrends. Meanwhile, the Relative Strength Index (RSI) sits at 26.37, deep in oversold territory. While this could hint at a short-term bounce, the RSI’s downward trajectory suggests bears remain in control.

Key Levels to Watch

- Resistance: A relief rally faces hurdles at $0.20 (psychological level) and the 50-day MA near $0.29.

- Support: Failure to hold $0.19 may trigger a slide toward $0.15, a level last seen in mid-2024.

Market Sentiment: Can DOGE Recover?

Despite oversold conditions, analysts warn that Dogecoin’s path to recovery hinges on reversing negative catalysts. The absence of bullish drivers—such as renewed institutional interest or Musk-related hype—leaves DOGE vulnerable to further declines. Elevated trading volume confirms strong bearish participation, with retail traders leading the exodus.

The Bottom Line

Dogecoin’s 2024 rally has unraveled swiftly, driven by geopolitical shocks, regulatory uncertainty, and a retail investor exodus. While oversold technicals might invite speculative buyers, the dominant narrative remains bearish. For DOGE to regain momentum, it must reclaim $0.20 and stabilize above it. Until then, the meme coin risks extending its losses in a market increasingly wary of volatility.

Stay tuned for updates as developments around Trump’s policies, Musk’s regulatory battles, and broader crypto market trends unfold.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are volatile and high-risk.

Leave a Reply