- Bitcoin price falls below $90,000 on Tuesday after dropping 4.89% the previous day.

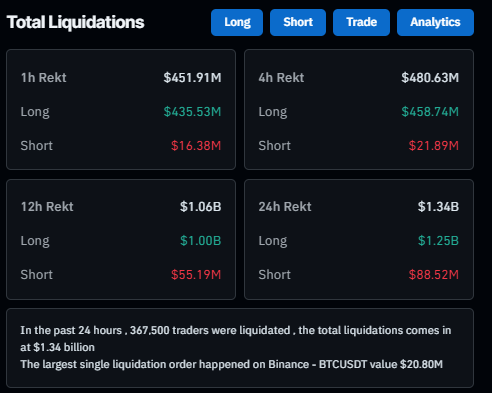

- The total liquidations are $1.34 billion, with 367,500 traders wiped out in the past 24 hours.

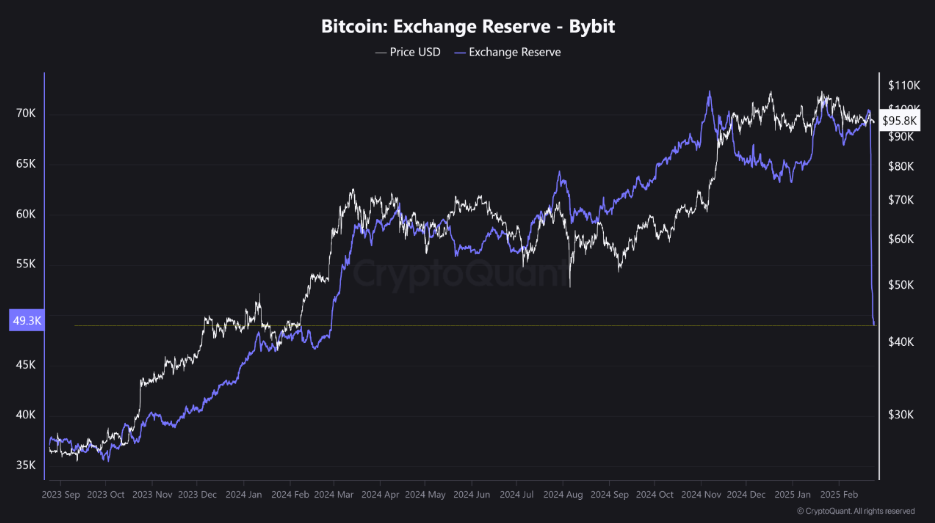

- After its recent exchange compromise, Bybit loses around $2 billion in BTC from reserves.

The cryptocurrency market experienced significant turmoil as Bitcoin (BTC) dropped below the critical $90,000 threshold on Tuesday, ending a period of consolidation and triggering widespread panic. The flagship cryptocurrency fell to $88,200 during European trading hours, its lowest point since mid-November, as investors rushed to sell amid a confluence of negative factors.

Crypto Market Bloodbath: $1.34 Billion Liquidated, 367,000 Traders Affected

Bitcoin’s 4.89% decline on Monday initiated a cascade of liquidations across exchanges. Data from Coinglass indicates that $1.34 billion in leveraged positions were liquidated within 24 hours, impacting 367,500 traders. The largest single liquidation, a $20.8 million BTC/USDT trade, occurred on Binance, highlighting the scale of the sell-off.

This wave of liquidations has intensified fears of a deeper market correction. Analysts warn that the rapid succession of forced sales could further escalate panic, potentially driving Bitcoin to lower support levels. “When markets decline this rapidly, fear becomes a self-fulfilling prophecy,” one trader commented. “Everyone is asking: How low will it go?”

Bybit Security Breach: $2 Billion in Bitcoin Lost From Reserves

Adding to the market’s woes, the Bybit exchange suffered a major security breach last week, resulting in the loss of approximately $2 billion worth of Bitcoin from its reserves. CryptoQuant reports that 20,190 BTC disappeared from Bybit’s holdings between Friday and Tuesday, reducing its reserves to levels seen in early March 2024. The breach, initially reported as a $1.4 billion theft, escalated as panicked users attempted to withdraw funds, a process Bybit struggled to manage.

James Toledano, COO of Unity Wallet, stated, “The Bybit hack severely damaged investor confidence at a critical time. While they have covered the losses, this incident reinforces the importance of self-custody wallets. Centralized platforms cannot be fully trusted with your keys.”

Bitcoin Price Forecast: Potential Drop to $85,000?

Bitcoin’s fall below the $94,000 support level has prompted analysts to consider further declines. The daily Relative Strength Index (RSI) is now at 30, approaching “oversold” territory, suggesting that bearish momentum may persist. If selling pressure continues, Bitcoin could test the $85,000 support zone, a level last seen during October’s rally.

However, historical data shows that Bitcoin has often rebounded sharply from oversold RSI conditions. A recovery above $90,000 could restore bullish sentiment, with $100,000 remaining a key psychological target. For now, high volatility is expected.

The Path Forward: Security Concerns and Market Psychology

The combined impact of exchange hacks and mass liquidations has revealed vulnerabilities in the cryptocurrency market. While Bitcoin’s long-term fundamentals, such as ETF inflows and the halving event, remain strong, short-term sentiment has been significantly impacted. Traders are now evaluating whether this dip represents a buying opportunity or the beginning of a prolonged downturn.

As Toledano emphasized, “Incidents like Bybit’s breach underscore that decentralization is essential, not optional.” Restoring trust in exchanges and stabilizing leveraged markets will be crucial for Bitcoin’s recovery. Until then, market volatility is likely to continue.Sources and related content

Leave a Reply